A trusted CPA and Realtor with over 30 years of experience

Meet Shiraz – an experienced CPA and Realtor with 35+ years of tax expertise and a decade-long career in real estate. Shiraz excels in tax guidance for individuals and businesses, notably in retail, convenience stores, gas stations, and W-2 professionals. He adeptly navigates residential and commercial markets, specializing in 1031 exchanges for optimal tax benefits.

His commitment to excellence and comprehensive understanding of tax intricacies position Shiraz as a trusted advisor. His dedication to client success across multiple domains distinguishes him as a preeminent professional in tax consultancy and real estate services.

CPA Services

Individual and Business Tax Preparation

We can help individuals and

businesses prepare and file their tax returns accurately and on time. We can also

provide tax planning strategies to minimize tax liabilities.

IRS and Sales Tax audit representations

We can represent individuals or businesses in

dealing with the Internal Revenue Service (IRS) and California Department of Tax and

Fee Administration (CDTFA). We represent our clients with audits, appeals, and related

income and sales tax disputes.

Complete Bookkeeping

We can assist with financial record-keeping, including

reconciling bank statements and generating financial reports.

We prepare financial statements such as income statements, balance sheets, and cash

flow statements, which are essential for business owners and investors to understand

their financial position.

Payroll and sales tax services

We offer full payroll services to our clients, including

payroll processing and filing payroll taxes. We also calculate sales tax and file sales tax

returns.

Real Estate Services

Real Estate Transactions

We represent our clients in all real estate transactions,

including buying, selling, investing, and 1031 exchanges. Our comprehensive service includes market analysis, pricing, listing, marketing strategies, staging, negotiating, and contract documentation. We assist our buyers with their real estate needs based on their preferences and budget.

Real Estate Analysis and Tax Advice

For all real estate transactions, we offer comprehensive valuation, financing, and marketing analysis with related tax consequences for your transactions whether residential, commercial, investment, or land. Our goal is to structure real estate investments to maximize our clients’ tax benefits.

Mortgage Financing options

We educate clients on mortgage financing programs available such as reverse mortgages that require no monthly mortgage payments under a federally approved program for individuals aged 62 and over.

Blog posts

-

Blueprint: Accurate Record-Keeping for Smooth T...

Objective: To educate clients on the significance of maintaining accurate financial records throughout the year and guide them in using financial software or apps to simplify the tax preparation process. Key...

Blueprint: Accurate Record-Keeping for Smooth T...

Objective: To educate clients on the significance of maintaining accurate financial records throughout the year and guide them in using financial software or apps to simplify the tax preparation process. Key...

-

Year-Round Tax Planning Cheat Sheet

Year-Round Tax Planning Cheat Sheet For Clients: 1. Keep Records: Maintain organized financial records year-round, including income, expenses, and receipts. 2. Monitor Income: Stay aware of changes in income sources...

Year-Round Tax Planning Cheat Sheet

Year-Round Tax Planning Cheat Sheet For Clients: 1. Keep Records: Maintain organized financial records year-round, including income, expenses, and receipts. 2. Monitor Income: Stay aware of changes in income sources...

-

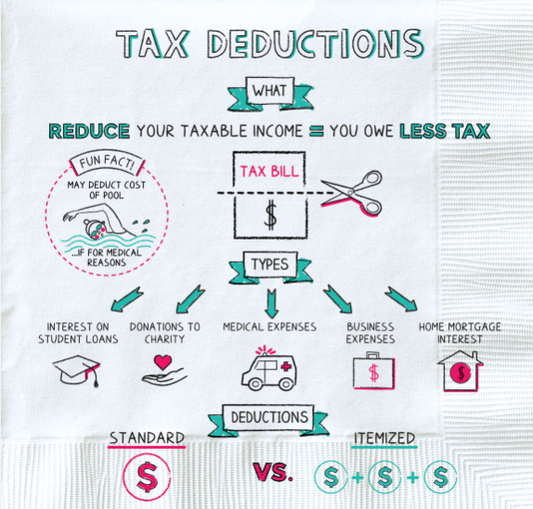

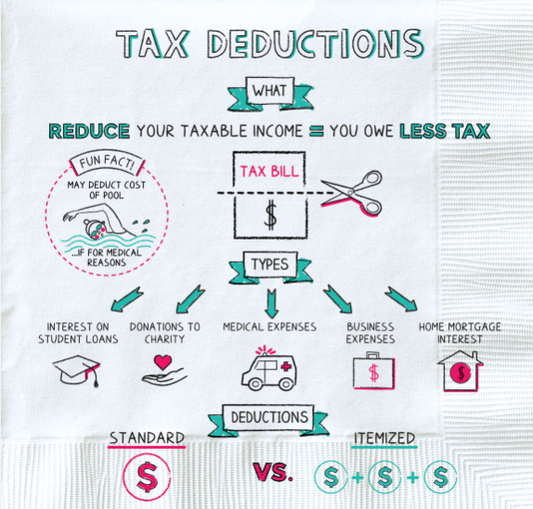

Maximize Deductions: Your Guide to Tax Savings

Maximize Deductions: Your Guide to Tax Savings Taxes are an integral part of our financial lives, but did you know that there are numerous deductions available that can reduce your...

Maximize Deductions: Your Guide to Tax Savings

Maximize Deductions: Your Guide to Tax Savings Taxes are an integral part of our financial lives, but did you know that there are numerous deductions available that can reduce your...

TRACY OFFICE

West Park Executive SuiteS

672 West 11th Street

Tracy, CA 95376

Get Started

Your financial well-being is out top priority. Let's work together to achieve your goals with confidence and clarity!