Maximize Deductions: Your Guide to Tax Savings

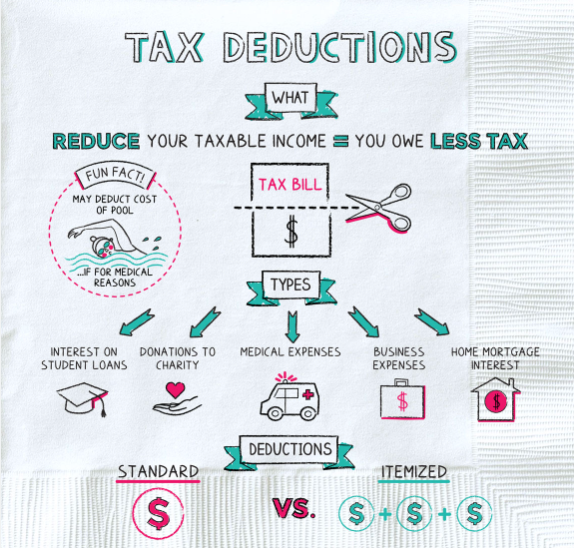

Taxes are an integral part of our financial lives, but did you know that there are numerous deductions available that can reduce your taxable income? In this guide, we'll explore common tax deductions, helping you maximize your savings and achieve a more tax-efficient financial plan.

1. Home Office Expenses for Self-Employed Individuals:

- If you're self-employed and use part of your home regularly and exclusively for business purposes, you may qualify for a home office deduction.

- Learn the criteria and record-keeping requirements to ensure you claim this deduction accurately.

- Understand the deductions available for home-related expenses like mortgage interest, utilities, and property taxes.

2. Education Expenses:

- Are you pursuing higher education or helping your dependents with their education? There are tax deductions and credits available to ease the financial burden.

- Explore deductions for qualified tuition and related expenses, the American Opportunity Credit, and the Lifetime Learning Credit.

- Ensure you meet the eligibility criteria for each education-related deduction and make the most of these tax benefits.

3. Charitable Contributions:

- Charitable giving not only benefits the causes you care about but can also lead to valuable tax deductions.

- Discover the types of contributions that qualify for deductions, whether it's monetary donations, donated property, or volunteering your time.

- Keep precise records of your charitable activities and donations to ensure proper deduction claims during tax season.

4. Documentation and Record-Keeping:

- Accurate record-keeping is crucial to claim deductions successfully. Learn how to maintain organized records of your expenses, contributions, and other deductible items.

- Understand the documentation requirements set by the IRS and explore the benefits of digital record-keeping tools.

5. Professional Guidance:

- While understanding deductions is essential, professional guidance can help you navigate complex tax laws and ensure you maximize your savings.

- Consider consulting a tax professional or advisor who can tailor your tax strategy to your unique financial situation.

Take Control of Your Finances:

Maximizing deductions is a smart financial move that can lead to substantial tax savings. By staying informed about eligible deductions, maintaining accurate records, and seeking professional guidance when needed, you can take control of your finances and achieve a more tax-efficient future.